Primary Residence Credit Application Deadline Is April 1

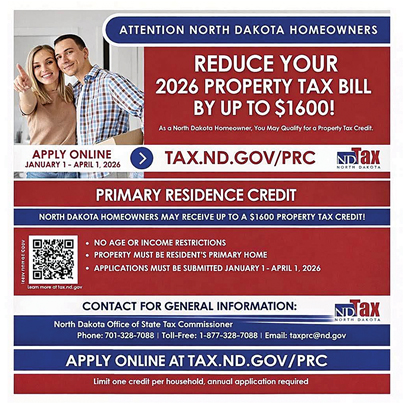

Residents across the state are being encouraged to apply for the Primary Residence Credit. The original credit was established during the 2023 Legislative Session under House Bill 1158. The credit provided all North Dakota homeowners with the option to apply for a state property tax credit through the North Dakota Office of State Tax Commissioner. Homeowners with an approved application received up to a $500 credit against their property tax obligation. In the 2025 legislative session, that credit was raised to $1,600 with many homeowners benefiting from this eliminating much if not all of their property tax responsibilities. Special assessments are not eligible for this credit.

To be eligible for the credit, you must own a home (house, mobile home, town home, duplex, or condo) in North Dakota, and reside in it as your primary residence. There are no age restrictions or income limitations for this credit. Only one Primary Residence Credit is available per household.

Mountrail County Director of Tax Equalization Kim Savage is encouraging all residents in Mountrail County to apply for the credit. The deadline to apply is April 1, 2026. If you applied for the credit previously, the process is simplified to reapply for the credit in 2026.

Once a resident completes the application, they are given a confirmation number that the application was received. The approved credit will be shown on the 2026 tax statement that residents will receive in December of this year.

The credit will be up to $1600. The approval amount depends on the total balance of a property’s taxes. If the taxes are below $1600, only the amount of the taxes will be applied. The credit does not apply to special assessments.

In addition to this credit, Savage encourages those that are eligible to continue to apply for the Homestead Credit or Disabled Veterans Credit.

The Office of State Tax Commissioner began accepting Primary Residence Credit applications on January 1 with applications due by April 1, 2026. Residents with questions on the application process can contact their office at 701-328-7988, 1-877-649-0112 or via email at taxprc@nd.gov.

Savage says that anyone with questions can also call their office at 701-628-2425. For assistance in filing, the Mountrail County Director of Tax Equalization Office is located in the basement of the Mountrail County Courthouse. They can help you not only with the filing, but also in finding your parcel number if you did not apply last year.

To apply for the Primary Residence Tax Credit, go to the ND State Tax Commissioner’s website at tax.nd.gov/prc.

The State Tax Commissioner’s website addresses many of the frequently asked questions including:

Who is eligible to apply? Anyone who owns and occupies a dwelling in North Dakota and uses it as their primary residence.

What is considered a primary residence? A dwelling occupied by an individual as their primary or principal residence.

How and when do I apply? The 2026 real property application and 2027 mobile home application period for the Primary Residence Credit is open January 1-April 1, 2026.

What is the Primary Residence Credit amount? The Primary Residence Credit amount is up to $1600 for an approved application and cannot exceed the amount of property tax due.

Is there a paper application process for the Primary Residence Credit? No. The application process is online only.

If I don’t have access to the internet, how do I apply? You can reach out to our office at 701-328-7988 or 1-877-649-0112 for assistance.

Can an individual who owns more than one home claim more than one primary residence? No. An individual may not have more than one primary residence.

Can persons who reside together as spouses claim more than one Primary Residence Credit? No. Only one Primary Residence Credit is available per household.

(Persons who reside together, as spouses or when one or more is a dependent of another, are entitled to only one Primary Residence Credit between or among them.)

If my Primary Residence Credit application is approved, when will I receive my credit? Constructed or manufactured home on a lot you own: Upon approval, the credit will be shown as a deduction on your 2026 property tax statement (your 2026 statement will be mailed to you in December, 2026).

Mobile or manufactured home on a lot you lease, paying property taxes in advance: Upon approval, the credit will be shown as a deduction on your 2027 property tax obligation.

How do I find my Parcel Identification Number? Your Parcel Identification Number is shown on the top left corner of your property tax statement.

Can an individual be eligible for more than one type of property tax credit? Yes. If you have been approved for the Homestead or Disabled Veteran’s Property Tax Credit and still have a balance due, you can receive an up to $1600 Primary Residence Credit for any remaining property taxes owed.

I own a mobile home and applied for the PRC during the special application window this past summer (July 14 through September 1, 2025), do I need to apply again during the January 1-April 1, 2026 application period? Yes. Due to the fact that mobile homeowners pay for their property taxes in advance, the applications taken during the special application window will be applied to the 2026 property tax year. Applications received during the January 1-April 1, 2026 application period will be applied to their 2027 property tax obligation.