2025 Tax Statements Reflect County Mill Levy Increase

Taxpayers in Mountrail County either should have received their annual tax statements in the mail recently or they will soon.

This year, the Mountrail County levy has increased their mill levy from 1.21 last year to 3.99 this year. That comes as the county has added levies for the District Health Unit, and reapplied levies for the county library and county airport. The remainder of the levy comes from the levies that were in place last year for the historical society and senior citizens.

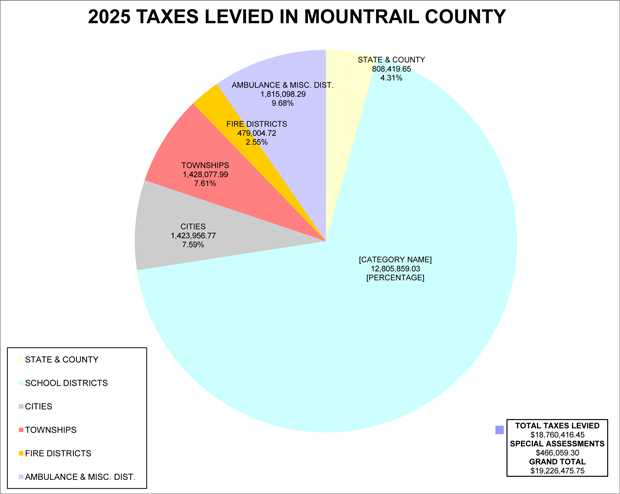

Overall tax collections will increase this year by $670,298.82 to a total of $22,296,069.15. Last year’s tax collection was $21,625,770.33 including special assessments certified.

Total mill levies increased just 2.78 mills after seeing a increase of .05 mill last year.

The mill levy sits at 3.99 for the county and 4.99 for the county and state. Last year’s levy was 1.21 for the county and 2.21 for the county and state. The 2023 levy was 1.16 for the county and 2.16 for the county and state. The levy in 2022 was 11.17 for the county and 12.17 for the county and state. In 2021 the levy was 16.59 for the county and 17.59 for the county and state. The levy in 2020 was 33.35 for the county and 34.35 for the county and state.

Valuation of property throughout the county was higher this year. Overall there was a total increase of 9,788,476. This comes after seeing an increase of $4,690,859 in 2024, an increase of $11,099,801 in 2023, an increase of $4,004,137.00 in 2022, an increase of $2,909,125 in 2021, and an increase of $5,021,605 in valuation in 2020.

Township valuations increased by $6,400,437 this year.

The agricultural, residential and commercial properties increased $3,172,102 to $61,450,809, up from $58,278,707 in 2024.

The public utilities in the townships increased $3,228,335 to $82,992,896, up from last year’s valuations of $79,764,561.

Cities valuations increased this year, up $3,388,039 to $36,874,635, up from last year’s valuation of $33,486,596.

The agricultural, residential and commercial properties increased from $31,579,959 in 2024 to $34,944,665, an increase of $3,364,706. The utilities in the cities increased from $1,906,637 in 2024 to $1,929,970 an increase of $23,333.

The total taxable valuation in the county increased to $181,318,340 in 2025, up from $171,529,864 in 2024.

Total tax levies this year will change in the following ways. Township collections will increase $73,679.67 from last year, going from $6,379,263.64 in 2024 to $6,452,943.31 this year.

City dollar amounts levied will increase $78,363.52 from last year, going from $4,727,281.69 in 2024 to $4,805,645.21 this year.

Total levies will increase $152,043.19 from $11,106,545.33 in 2024 to $11,258,588.52 this year.

The public utilities certified, including pipelines in the county, are seeing increases this year. Those certified with taxable valuation will see collections change as follows:

Railroads will increase $13,050.90 from $373,553.59 to $386,604.49. Electric, gas and heat utility companies will increase $19,306.51 from $86,615.13 to $105,921.64. Pipelines will increase $235,580.60 this year, going from $7,898,858.69 to $8,134,439.29 this year. Overall public utilities will increase $267,938.01 going from $8,359,027.41 last year to $8,626,965.42 in 2025.

Public utilities certified with taxable dollars will change as follows:

R.E. Coop taxes will increase from $1,692,965.18 in 2024 to $1,944,455.91 this year.

Total special assessments certified throughout the county will decrease from $467,232.41 in 2024 to $466,059.30 in 2025.

These numbers add up to the total taxes levied from $21,625,770.33 last year to $22,296,069.15 this year.

Mountrail County levies will be as follows:

State Levy

State Medical Center, 1 mill

Mountrail County Levies

General Levy, zero mills, the same as last year.

County Road and Bridge, zero mills, the same as last year.

Farm to Market Roads will have no levy, the same as last year.

Veterans’ Service Officer, zero mills, the same as last year.

County Agent, zero mills, the same as last year.

Historical Society, .24 mill, up from last year’s .21 mill.

District Health Unit, 1.00 mills, up from a zero mill last year.

Human Services, which supports the Social Service Fund, will have no mill levy again this year. This was a change from the legislature which ended the 12% state credit on the tax statements.

Senior Citizens, 1 mill, the same as last year.

Water Management, zero mills, the same as last year.

Weed Control, zero mills, the same as last year.

Job Development Authority, zero mills, the same as last year.

County Library (which is not applicable to the cities of New Town and Stanley), will be .25 mills, up from zero mills last year.

County Airport (which is not applicable to the cities of New Town, Parshall, Plaza and Stanley), will be 1.50 mills, up from zero mills last year.

This represents a total of 4.99 mills possible with the state and county mill levy.

Each city and township also have their own mill levies, which go to support the various services of the city or township. In addition, there are levies for school districts, some fire districts and ambulances, as well as the Mountrail Soil District and Tioga Vector Control.

For the City of New Town, total levies will increase to 126.56. This includes 3.24 mills from the state and county, 67.08 mills for the school district, 1.10 mills for the soil district, 10.00 mills for the ambulance district, 43.53 mills for the city and 1.61 mills for the city park.

For the City of Palermo, total levies will increase to 107.71 mills. This includes 4.99 mills for the state and county, 90.00 mills for the school district, 2.86 mills for the fire district, 1.10 mills for the soil district and 8.76 mills for the ambulance district. This year there is no city levy.

For the City of Parshall, total levies will decrease to 74.64. This includes 3.49 mills for the state and county, 0 mills for the school district, 5.00 mills for the fire district, 1.10 mills for the soil district, 5.00 mills for the ambulance district, 52.77 mills for the city, and 7.28 mills for the city park.

For the City of Plaza, total levies will increase to 162.97 mills. This includes 3.49 mills for the state and county, 130.28 mills for the school district, 5.00 mills for the fire district, 1.10 mills for the soil district, 5.00 mills for the ambulance district, 14.94 mills for the city and 3.16 mills for the city park.

For the City of Ross, total levies will increase to 159.16 mills. This includes the 4.99 mills for the county and state, 90.00 mills for the school district, 2.86 mills for the fire district, 1.10 mills for the soil district, 8.76 mills for the ambulance district, and 51.45 mills for the city.

For the City of Stanley, total levies will increase to 175.81 mills. This includes the 3.24 mills from the state and county, 90.00 mills for the school district, 1.10 mills for the soil district, 8.76 mills for the ambulance district, 50.75 mills for the city and 21.96 mills for the city park.

For the City of White Earth, total levies will increase to 87.06 mills. This includes the 4.99 mills from the state and county, 80.97 mills for the school district, and 1.10 mill for the soil district. Again this year, there is no city levy for the general fund.

Townships throughout the county also vary in their mill levy totals from 16.09 to 164.38 mills, depending on the school district, fire district, other special districts and township levy amounts. All are based with the 4.99 mills from the state and county.

Following is an example of the tax liability for a person living in the City of Stanley with a home and lot valued at $100,000 total true and full value in 2024 and 2025 with a $4500 taxable value.

The 2024 mill levy of 174.22 mills produced a net tax of $783.99. That broke down into $9.95 to the State and County, $323.60 to Stanley City, $405.00 to the Stanley School District, $5.08 to the Soil District and $40.36 to the Ambulance.

The 2025 mill levy of 175.81 mills will produce a net tax of $791.14. That breaks down into $14.58 to the State and County, $327.19 to Stanley City, $405.00 to the Stanley School District, $4.95 to the Soil District and $39.42 to the Ambulance.